- home

- project

- Forschung

- research

- investigación

- исследование

- recherche

- BWL

- Betrieb

- Finanzen

- Noteninflation

- Schummelkultur

- Akademisierung

- Männerrechte

- Politik

3.7. Cost Accounting and Controlling

3.7.1. Internal Accounting

The original claim of the accounting was to provide the merchant with information about his business and the economic situation. Only later did the state make use of the existing methods, and

introduced an accounting obligation and reporting obligations. The management approach assumes that the accounting system is designed first for one's own needs and only as a secondary purpose

must comply with state regulations and fulfil statutory obligations.

The concern of the company management is to analyse, to understand and to improve the value added process shown simplified in Fig. 1 on page 9. At the same time, it should be borne in mind that

the company is run not in the past, but in the future. To do this, the basis for decision-making for the future must be created with plans based on up-to-date data. The current data is compared

to the plans of the past to deviations between plan and is to analyse. This leads to the desire to organize learning processes and to constantly improve the company management with the help of

planning, information systems and feedback. According to this philosophy, the task of business administration is the optimization of value creation via the action levels

planning-implementation-evaluation and the support with information systems and learning processes. In addition to capital and labour, the factor information can be regarded as an important

component in the creation of the company's performance. Accounting has been the company's central information system for more than 500 years. With the technical possibilities of the 21st century,

the database for corporate management can be greatly expanded. In addition, information gathering can be accelerated and organized cost-effectively.

Fig.12: continuous improvement process

(Source: https://mueller-consulting.jimdo.com/research/background/)

The planning of the future, the implementation of these plans and their control is the central concern. Reporting has the goal of a comparison based on this comparison The approach of cost

accounting, the business value creation with the questions for "what? Where? for what? ", so in the reporting comes together with the demand for cost control, which has to ask the question" when?

", and compares current data with past values and compares them to target / actual. The task of this link visualizes the following Mickey-Mouse-Chart:

Fig. 13: Four dimensions of reporting

(Source: W. Müller, Cost Accounting, Norderstedt 2012, p. 22)

On the other hand, the activity statement sheets (BAB) I and II have the task of analysing the value chain Input => Production => Output. BAB I shows how the cost elements (purchased goods)

are distributed among the cost centres (organizational units in which the value added takes place). Here is between direct costs, which can be directly attributed to the products, and overheads,

where this is not possible. In the BAB II, on the other hand, it is about the contributions of the cost centres for the products.

Fig. 13a: activity statement sheets I and II

(Source: own representation)

On the other hand, the activity statement sheets (BAB) I and II have the task of analysing the value chain Input => Production => Output. BAB I shows how the cost elements (purchased goods)

are distributed among the cost centres (organizational units in which the value added takes place). Here is between direct costs, which can be directly attributed to the products, and overheads,

where this is not possible. In the BAB II, on the other hand, it is about the contributions of the cost centres for the products.

If you wanted to combine both, you would have to create a four-dimensional representation, but this is not possible with the only three-dimensional imagination of man (length, width, height).

However, databases do not have this restriction. You can also capture and store information with features of more than three dimensions. Only the summarized evaluations must omit one or two

dimensions.

3.7.2. Cost Centres and Products

It is possible to machine the computational transfer from input to output. For this purpose, a cost centre number must be entered in the accounting department next to the account number, but this

can also define the cost unit for individual costs. This generates a cost centre / cost element file from which evaluations are produced as a file and can then be transferred to a

spreadsheet:

Fig. 14: data flow for cost and activity accounting

(Source: W. Müller, Cost Accounting, Norderstedt 2012, p. 10)

A sample file for this can be downloaded at https://www.noteninflation.de/ downloads/ (file: BAB-Muster.ods) to adapt to your own requirements.

The account number may also include cost unit information, e.g. with a 5-digit number the first two for the cost centre and the last three for the cost bearer envisages. The cost centres starting with 0 would be for non-company transactions, which should not be included in the cost accounting. In the numbers starting with 8 and 9, no cost object reference would be possible. They can be used as five digits as cost centres. The following example graphically illustrates this idea:

Fig. 15: cost centre numbers

(Source: W. Müller, Cost Accounting, Norderstedt 2012, p. 103)

For cost centres beginning with digits from 1 to 7, the last three digits would be payers. "000" would mean that no payer can be defined. In the example, the numbers 900-999 would be reserved for

cost centres, as special evaluation units within cost centres. The numbers 001 to 099 would be provided for projects (temporary billing units) and operating orders (internal cost units).

The machine evaluations for the data transmission would concern cost centre groups, which together form a column in the BAB I. Cost centre groups could also be created for the cost objects, which

additionally generate evaluations that support the system of unit costing. Instead of integrating the cost objects into the cost centre number, separate cost centre numbers can also be maintained

in separate data fields. However, it has to be taken into account that the cost bearers can only be recorded consistently if there are direct costs. Because the additional cost centre number

would always be left over in the overheads area, this would mean a significant expansion of the system with little use of the additional dimension.

The entry of cost centre numbers in accounting has realized the idea of a direct acquisition of cost accounting information, which was already planned with the cost centre accounts in the 30s to

50s and was rejected as too expensive again. Computerized cost accounting can thus do with a minimum of human labour, which would be needed only for their set-up and adjustments.

3.7.3. Responsibility Reporting

Reporting as a part of Management Accounting (Controlling) is based on areas of responsibility to which specific persons can also be assigned. This happens according to the following

pattern:

Fig. 16: Management feedback

(Source: W. Müller, Integrierte Erfolgs- und Finanzplanung,

2nd ed., Aachen 2004, p. 26)

Here, on the basis of experiences of the past, goals are first defined, the observance of which is to be observed with the numbers of the respective periods. The areas of responsibility are

regularly delimited according to technical responsibilities and therefore essentially correspond to the cost centres (= cost centre approach). It happens, however, that several cost centres form

a common area of responsibility. In the operational hierarchy, the higher-level area of responsibility also includes the areas of responsibility assigned to them.

In the continuous improvement process shown in Fig. 12 on page 64, the reporting covers the feedback. With this feedback for the management, it should be checked in the sense of an early warning

system, whether the respective organizational unit reaches its goals, or whether a course correction makes sense.

There is a distinction between:

Fig. 17: time sequences and periods in reporting

(Source: W. Müller, Cost Accounting, Norderstedt 2012, p. 23)

This illustration introduces the terms budget and forecast, which in addition to the questions What? Where? and for what? Asks even the question When? The question of the "when?" has not yet been

discussed and should be examined here. It is the central question of reporting and is also important for cost accounting. It can be distinguished as follows between time periods and periods,

which only seemingly form synonyms.

Separate databases must be kept for the different periods of time, in which time periods are then delimited. The data flow and the necessary file structure can be displayed with the following

chart:

Fig. 18: File structure of the reporting

(Source: W. Müller, Cost Accounting, Norderstedt 2012, p. 27)

Each of the files must have the same structure of cost elements and cost centres.

3.7.4. Activity Reporting

The reporting concentrates in the matter on the reporting of the areas of responsibility (where?) And the subject of the operational performance (for what?). The second question is presented as a

segment report in annual reports according to international regulations. Previously IAS 14 differentiated into business segments (product groups) and geographical segments, which in turn could be

built according to the location of the customers and the location of the permanent establishment or subsidiaries. With the introduction of IRFS 3, the geographical segments have been discontinued

in segment reporting. IFRS 8 is now required for the segment report. Its contents are regulated in particular in IFRS 8.23.

It is also possible that the organizational structure of a company follows the Profit Centre Approach and divides the areas of responsibility according to the object principle (products) instead

of the performance principle (activities). Then the reporting system would have to be structured according to areas of responsibility. For a matrix organization combining both the task and the

object principle, Cost Centre and Profit Centre Approaches are to be combined. The technical implementation can be carried out with the combined cost centre / cost unit number according to Fig.

15 on page 68, which can be done according to cost centre groups both for the execution principle with the first two digits, as for the object principle with the last three digits. The object

principle will additionally incorporate the results of the BAB II.

But even with a classic expansion organization according to the performance principle, additional information about the various business units outside the segment report makes sense as feedback.

For this, the periods according to Fig. 17 on page 71 should be compared not only with cost centres but also with cost units. Only the question of responsibility for a course correction would

then have to be clarified in individual cases.

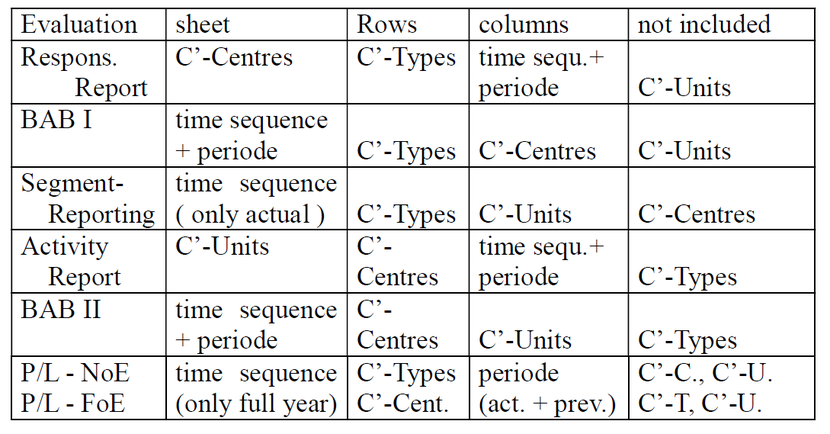

3.7.5. similarities and differences

Because of the limitation of a sheet of paper on rows and columns, which applies to a file accordingly, individual evaluations are patchy. A third dimension can still be taught with several

evaluations (sheets of paper) in the same row-column format. However, the four dimensions of company data (see Section 3.7.1) can only be conveyed through a combination of several

evaluations.

Responsibility reporting cannot report on cost units or activity reporting on cost centres. The profit centre structure, which defines the objects and therefore the cost objects as cost centres,

omits the analysis of the task fulfilment (question: where?). This is also followed by the segment report in quarterly and annual financial statements in according international standards.

But also the evaluations of the cost and performance calculation (BAB I + II), which do not perform a target / actual comparison, have a comparable presentation gap. Because only one sheet is

created here for a selected period of time / period, there is only a two-dimensional representation. Here, the BAB II (lines: cost centres / columns: cost units) builds on the BAB I (lines: cost

elements / columns: cost centres) in order to achieve a consideration of these three dimensions. The income statement in the annual financial statements has two alternative representations. The

total cost method according to Sect. 275 Abs.2 HGB makes a breakdown of the operating expenses by cost types; The cost of sales method according to para. 3 selects the cost centre classification.

The company has to choose one of the two formats here.

The individual processed evaluations have the following information or gaps:

Fig. 19: Evaluations in comparison

(Source: W. Müller, Cost Accounting, Norderstedt 2012, p. 33 -

The word "costs" was abbreviated for reasons of space with "C '")

The goal of feedback in the process of continuous improvement therefore does not demand the either-or-decision, but the both-and-also.